Money doesn’t bring happiness? Teenagers disagree.

A survey commissioned by Santander Bank Polska for the Finansiaki project reveals that more than 60 per cent of teenagers associate their happiness with having money. At the same time, more than half of teenagers aged 12-18 are worried about financial problems in their family.

The results of a survey of teenagers and parents commissioned by Santander Bank Polska show that six out of ten teenagers of all ages believe that they would feel happier if they had more money and could buy more things. One in two parents surveyed are of the same opinion. Almost half of younger children aged 12-15 say they like people who have 'cool’ things and clothes, while as they get older this becomes less important. Only 23 per cent of teenagers aged 16-18 still consider it of importance.

Money also has a high significance for the teenagers surveyed in terms of future career planning. As many as 66 per cent of 12- to 15-year-olds only want a job that pays a high salary. Almost 60 per cent of teenagers aged 16-18 have the same desire.

The feeling that money and material possessions are something that can give us happiness and the respect of others, or a materialistic attitude, is often associated with high levels of financial anxiety. For materialists, it is important to own expensive items and live a luxurious lifestyle, and upholding this requires significant financial resources. In a situation of financial distress or economic crisis, such persons will experience higher levels of anxiety. They begin to fear that they will not be able to meet their consumer aspirations and these, in their view, determine their happiness and the respect they receive from others.

This is confirmed by the results of a Santander Bank Polska study. Money is also a source of anxiety for the majority of respondents. More than half of parents fear unemployment and as many as 86 per cent worry about the high cost of living. Parents’ fears affect their children, who are afraid of financial problems in their family. Data from the Santander Bank Poland’s study shows that as many as 57 per cent of children aged 12-15 and almost every second teenager aged 16-18 are afraid of their parents losing their jobs. This means that more than half of young people experience anxiety related to the precarious employment situation of their relatives.

Talking to teenagers about money

Half of the teenagers surveyed between the ages of 12 and 15 say they discuss finances with their parents, who are their main source of knowledge. However, this changes with age. Only 38 per cent of teenagers over the age of 16 bring up the subject of money with their parents.

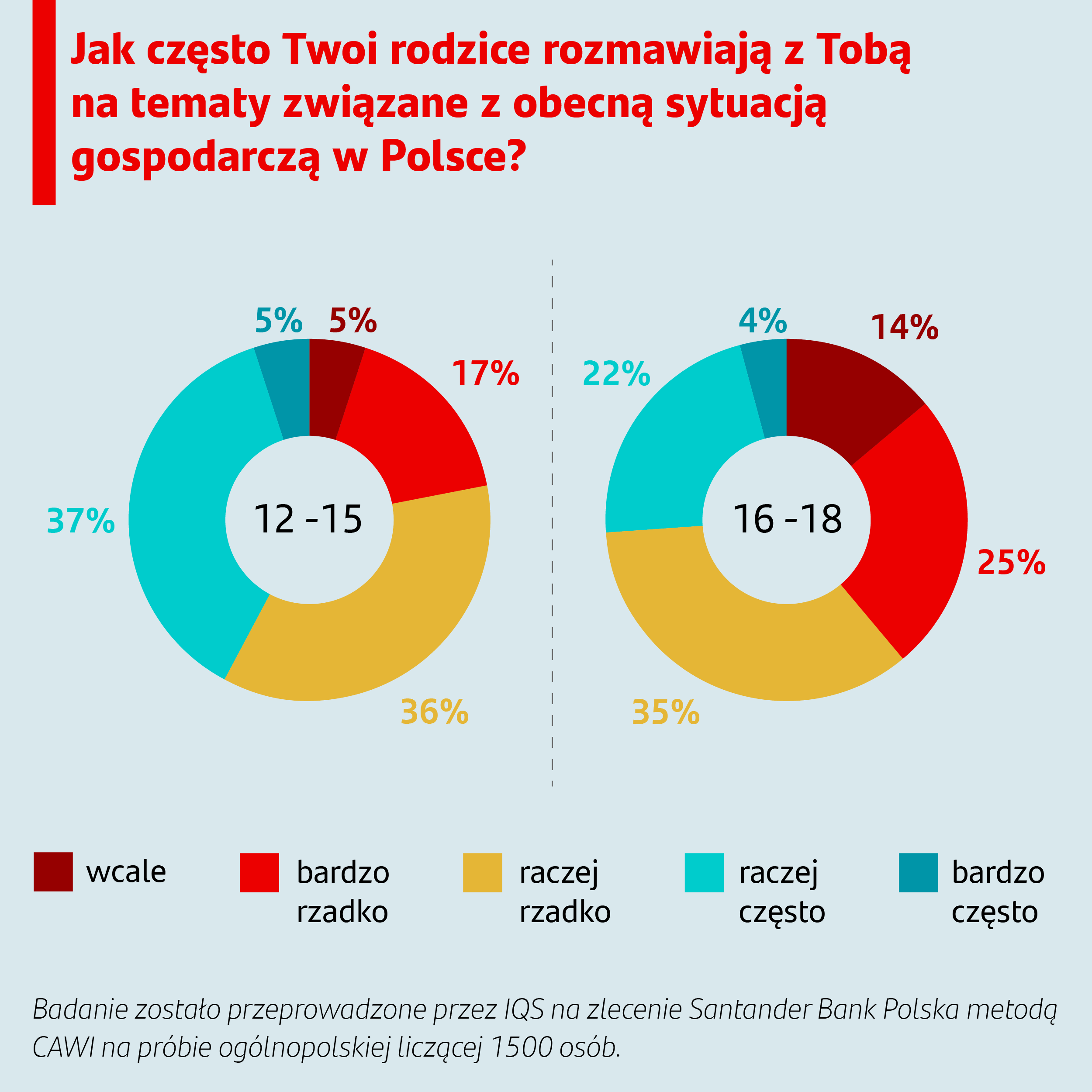

When it comes to discussing the economic situation, as many as 3 in 4 parents of 16-18 year-olds rarely or never have such conversations with their children. For younger children, almost 60 per cent of parents engage in such conversations rarely or never. However, 38 per cent admit that the current economic situation has prompted them to talk to their children more often about financial issues.

New generations are becoming increasingly materialistic, with teenagers becoming more and more focused on looks, popularity and money. Materialism can lead to debt in the future and a lack of ability to save money and manage finances properly. It is therefore important to try to curb young people's materialistic tendencies. In this context, it is worth noting that financial education is not only about knowing concepts and definitions, but also about instilling non-materialistic values in children, such as being close to family and friends, strengthening self-esteem, encouraging passions and building valuable relationships.

Resources and tips to help parents start conversations with their children about money, as well as lesson scenarios for teachers, can be found at www.finansiaki.pl.

The survey was conducted by IQS research agency on behalf of Santander Bank Polska for the Finansiaki programme. The study was carried out using the CAVI method on a sample of 1,500 people, including 500 parents, 500 teenagers aged 12-15 and 500 teenagers aged 16-18.