Sometimes we don’t have the words to talk about money

Poles believe they have quite good knowledge of personal finance. Despite this, only one third of us share such knowledge with our children on a regular basis, according to the latest survey commissioned by the Finansiaki educational programme carried out by Santander Bank Polska. More than half of the surveyed parents are of the opinion that their children can manage money well.

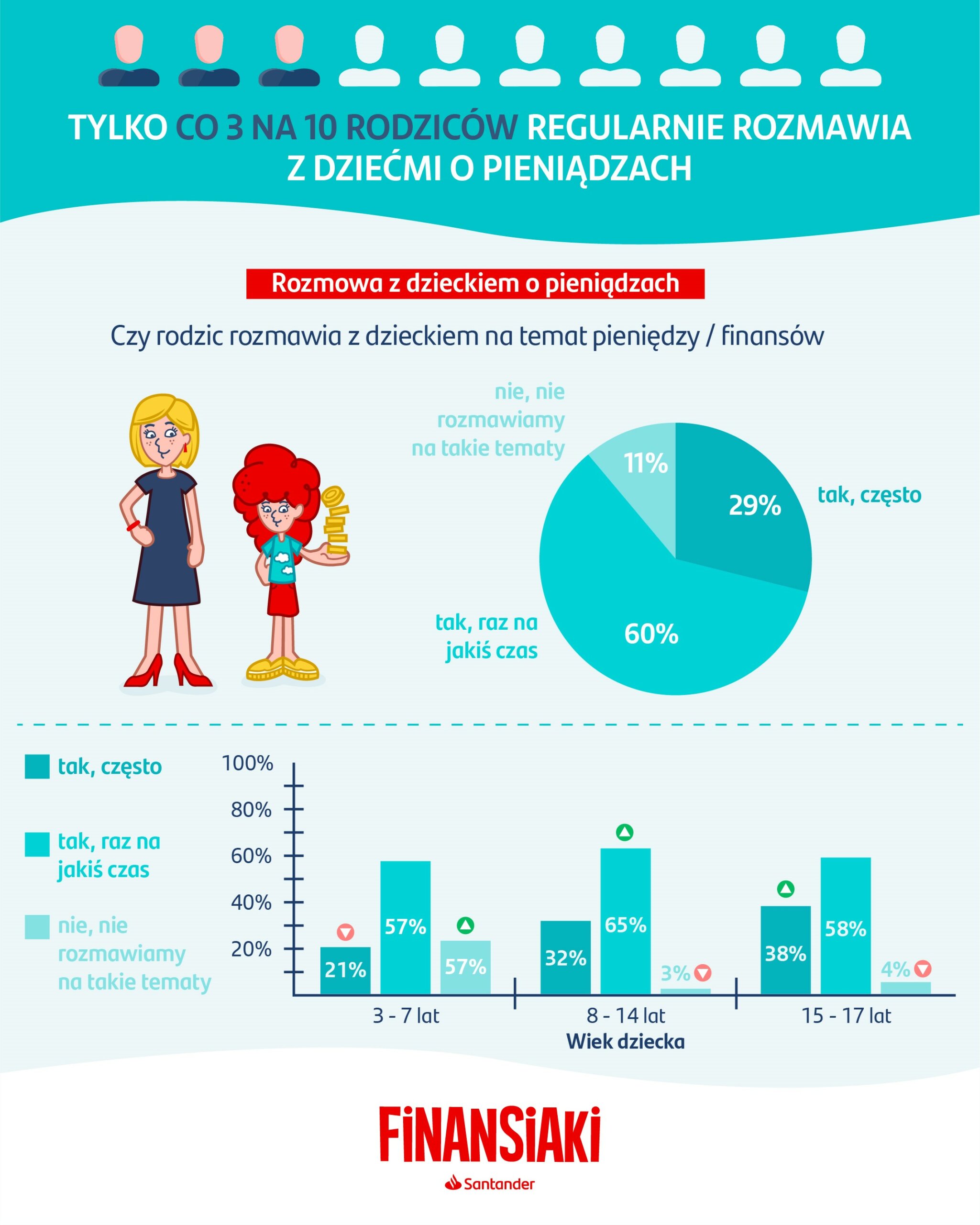

According to the respondents of the latest survey conducted by Grupa IQS for the Finansiaki project, education on personal finance for most children begins only at the school stage. On average, parents take up the subject of planning small expenses or saving after their child’s 7th birthday. Meanwhile, adults only discuss the value of money and responsible budget management with secondary school students. At the same time, every tenth parent surveyed does not bring up the subject at all, and only every third parent does so regularly.

Most children in Poland start receiving pocket money when they go to school. 80% of primary school pupils get pocket money for their own expenses. For most parents this is also a good opportunity to talk about money. A significant number of respondents (83%) assess their own knowledge of personal finance as sufficient to talk about it with their child.

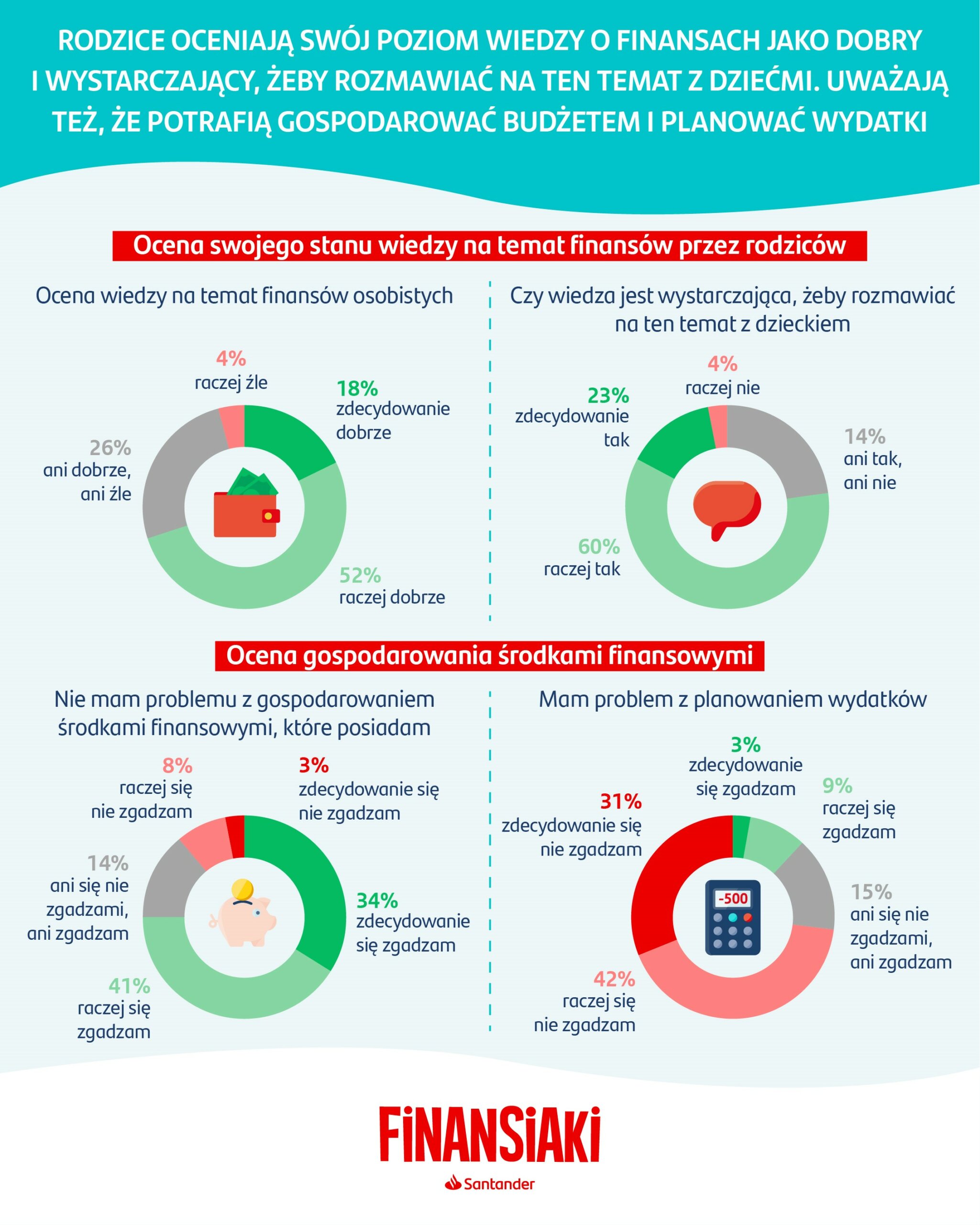

As many as 70% of parents are satisfied with their knowledge of finance: 18% consider it to be very good and 52% good. Poles also see themselves as ideal role models for their children when it comes to managing household budgets and finances. Three in four respondents (75%) declare that they have no problems managing their money and planning their expenses (74%). Additionally, more than half of parents (51%) believe their children can manage money as well. However, this percentage depends on the age of the children. Only 1/3 of parents of pre-school children have a positive view of their children’s approach to money. Among parents of older children, the corresponding figures are 58% (8-14 years) and 68% (15-17 years).

Only one in three parents regularly talks to their children about money

Although the study shows that parents are not lacking in knowledge and practical skills, only 3 in 10 parents regularly discuss finance with their children (29%), and 11% do not raise the subject at all. There is also a clear age dependency in this area, with 21% of parents having frequent discussions with their children aged 3-7, 32% with children aged 8-14, and 38% with teenagers (15-17). At the same time, of the parents of the youngest children, as many as 22% say they do not discuss finance with their children at all. In the case of older children, the respective percentages are 3 and 4%.

Interestingly, the most common situation when parents decide to talk about money is the child’s request to buy something that the parent does not want to buy, especially among parents of 3-7 year olds. In the case of children over the age of 8, planning to spend more money on equipment for the child, such as a computer or mobile phone, is also a reason to talk about the household budget. For 40% of families, joint trips are a good opportunity to talk about finances.

34% of parents say they bring up the topic of money and finances with their children in special discussions. In other households, these topics tend to arise naturally, when planning major expenses. It's worth remembering, however, that planning conversations about money in advance will make it easier to explain the value of money to children. Then it is easier to explain, in a rational way, why not everything the child wants can and must be bought. For example, when we are saving to buy things that are more necessary or we have larger expenses planned a long-time ago.

Difficult questions at any age

Although parents perceive their knowledge of personal finance as sufficient, many of them are at the same time surprised by difficult questions from their children, regardless of their age. Among the parents of the youngest children, 30% were confronted with a question to which they did not know the answer. Children aged 8-14 are even more likely to have difficult financial questions and 38% of the interviewed parents admitted that they were not always able to answer their children’s questions on this subject.

Although most parents try to educate their children about personal finance, they often need support in this area - if only to answer the often difficult and surprising questions. That's why at www.finansiaki.pl we have prepared educational texts, as well as games and activities to help parents start conversations about finances with their children. In our survey, respondents indicated that joint games are a particularly valuable aid in this area. 74% of parents of children aged 3-7 and 64% of parents of children aged 8-14 think so. The "Finansiaki" portal responds to these needs and shows how to teach children by playing together. Interested parents will find ready-made board games, interesting animations and quizzes that will allow them to introduce their children to the difficult subject of money in a friendly manner.

In order to facilitate family discussions about finances, Santander Bank Polska runs an educational programme „Finansiaki” targeted at parents and teachers. As part of the programme, a special Finansiaki website (https://finansiaki.pl) was created with materials expanding parents’ and children’s knowledge of the basics of economics, saving and banking, including a free online edition of the manual „Finansiaki to My!”. Adults will find tips on how to start difficult conversations about finances with children. And parents can also find interesting inspirations, competitions and games on the Finansiaki to My Facebook profile.