Almost PLN 1.6bn of subsidies granted to Santander Bank Polska customers

According to the Polish Development Fund, subsidies under the financial shield totalled PLN 8.742bn. As much as 18% of those funds (PLN 1.569bn) was transferred to Santander Bank Polska customers.

Currently, the average subsidy for an SME customer of Santander Bank Polska is PLN 113k, whereas the average subsidy for a corporate banking customer is PLN 932k. 7,150 customers have already received positive decisions on subsidy requests under the Polish Development Fund’s financial shield.

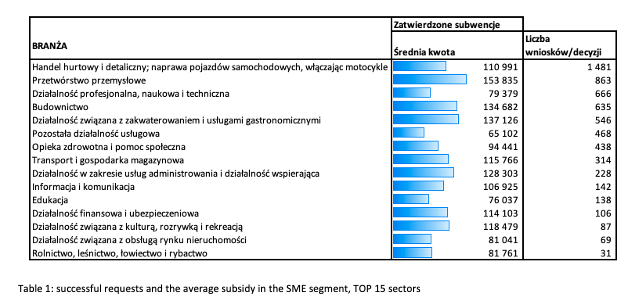

In the SME segment, the largest number (almost 1,500) of the successful subsidy requests was filed by customers from retail, wholesale, vehicle repair sectors, while customers from the industrial processing sector accounted for 863 of the successful requests. Further, customers conducting professional, scientific and technical activities filed 666 successful requests, customers from the construction sector filed 635 successful requests, while businesses operating in the accommodation and catering sector filed 546 successful requests.

To date, among large enterprises, the largest number of positive decisions has been given to distribution and production companies.

Subsidies are provided to businesses under the financial shield programme of the Polish Development Fund. Micro, small and medium companies (employing between 1 and 249 people) whose revenue decreased by 25% or more due to COVID-19 can file subsidy requests through online banking, also at Santander Bank Polska. Large enterprises with a consolidated balance sheet total over EUR 43m should apply for aid directly in the Polish Development Fund.

The bank will not charge you with any fees for processing your application. Moreover, Santander Bank Polska has also opened a special service at www.santander.pl/tarczapfr where you can find, among others, a calculator enabling you to estimate the aid amount and information about the application process